As a business owner, it may seem like you are constantly facing and dealing with problems in your business. Hardly a week goes by when you don't deal with some kind of problem, and more often than not, the solution seeks to part you with more of your hard-earned money. It's easy to get discouraged and to feel like the problems will never end.

As a business owner, it may seem like you are constantly facing and dealing with problems in your business. Hardly a week goes by when you don't deal with some kind of problem, and more often than not, the solution seeks to part you with more of your hard-earned money. It's easy to get discouraged and to feel like the problems will never end.

The natural cycle of business is for cash flow to fluctuate. Some months, your business generates plenty of money to cover all your expenses, but others, it seems like it's a constant struggle to make ends meet. When costly problems occur, it's hard to tell from one month to the next what the cash flow is going to look like.

Business cash advances can be a solution to these common cash flow fluctuations. Using these advances to even out the ups and downs can greatly reduce your daily stress and give you the steady cash flow you need to operate effectively. Here are some problems a business cash advance can solve.

All businesses seem to cut costs at one time or another. Businesses often need to cut costs in order to streamline and realign their priorities and increase profits. A merchant cash advance can help your business move forward and adapt to changing conditions.

All businesses seem to cut costs at one time or another. Businesses often need to cut costs in order to streamline and realign their priorities and increase profits. A merchant cash advance can help your business move forward and adapt to changing conditions. All too soon, the holiday shopping season will be upon us. Ecommerce sales have been increasing each year it has been in existence, and this year is expected to be no different. Due to some new trends in ecommerce, the overall market share is projected to grow to 9% of total retail sales this year, or $79.4 billion, up from 8.3% last year.

All too soon, the holiday shopping season will be upon us. Ecommerce sales have been increasing each year it has been in existence, and this year is expected to be no different. Due to some new trends in ecommerce, the overall market share is projected to grow to 9% of total retail sales this year, or $79.4 billion, up from 8.3% last year. From coast to coast and region to region, there are a large number of businesses in the United States that rely on one vehicle or a giant fleet of them. In fact, according to information found at

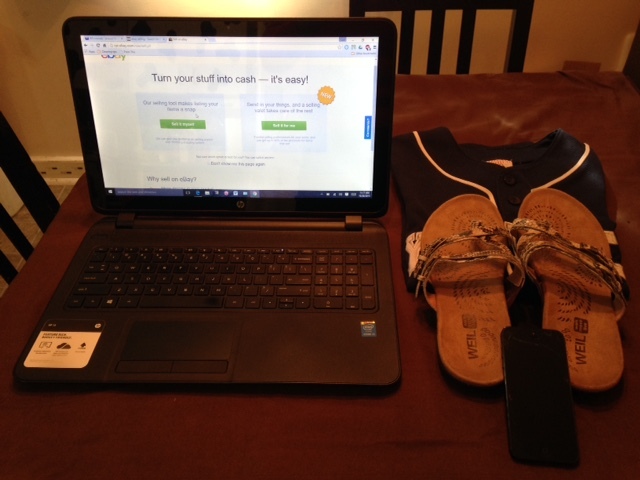

From coast to coast and region to region, there are a large number of businesses in the United States that rely on one vehicle or a giant fleet of them. In fact, according to information found at  Millions sell on eBay, but most sellers do so part-time or as a hobby, to declutter their homes profitably or recoup costs on items they no longer need. Selling on eBay full time takes know-how and dedication, and can take an influx of capital as well.

Millions sell on eBay, but most sellers do so part-time or as a hobby, to declutter their homes profitably or recoup costs on items they no longer need. Selling on eBay full time takes know-how and dedication, and can take an influx of capital as well.