Taxes are a certainty each year, yet for many small business owners, the accompanying refund is a much-anticipated boost—an infusion of capital that often plays a pivotal role in growth plans, day-to-day operations, or even stabilizing a particularly taxing financial year. But what happens when this wholesome cycle is disrupted by the excruciating wait for a refund? How do you emerge from the period of inactivity and potential cash flow conundrums?

Taxes are a certainty each year, yet for many small business owners, the accompanying refund is a much-anticipated boost—an infusion of capital that often plays a pivotal role in growth plans, day-to-day operations, or even stabilizing a particularly taxing financial year. But what happens when this wholesome cycle is disrupted by the excruciating wait for a refund? How do you emerge from the period of inactivity and potential cash flow conundrums?

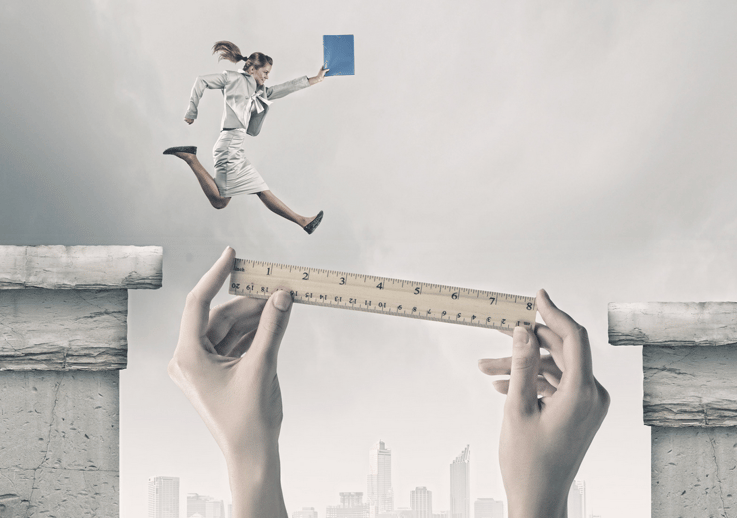

Enter the Merchant Cash Advance (MCA), a financial tool that can serve as an invaluable bridge, solidifying the path from tax season uncertainty to financial resolution.

The Tax Refund Timeline

For small business owners, filing taxes often means a substantial refund is on the way. Yet the wait for this refund can be a test of financial resilience. According to the IRS, the average tax refund in recent years has hovered around $3,000, an amount that could significantly improve cash flow, settle debts, or be reinvested back into the business. However, the actual cash realization of this refund, once the filing is complete, can be as long as six to eight weeks, if not more—certainly not conducive to running a tight ship in the often volatile waters of small business finances.

A Bridge Fund

A Merchant Cash Advance is a financing product that provides capital against a portion of your future credit and debit card sales. It's a short-term loan alternative that gives you quick access to funding, often with less stringent requirements than traditional loans. For the small business owner, an MCA can act as the much-needed bridge, covering expenses or investments while the tax refund is in transit. Imagine it as a financial safety net, ready to be utilized when growth opportunities arise or when operational stability is at risk.

Eligibility And Acquisition

The appeal of an MCA compared to a conventional loan lies in the relaxed eligibility criteria. Since an MCA provider looks primarily at your business's credit card sales history and not just the credit score, businesses that might not qualify for a bank loan can often secure an MCA. The process to acquire an MCA is relatively straightforward, with minimal paperwork. Once approved, funds can be available within days, offering a swift solution to any pressing financial need.

The Characteristic Of A Financial Bridge

The significance of an MCA in bridging the gap during the tax refund wait is not merely transactional. It's symbolic of a resilient and proactive approach to small business finance. Rather than viewing a tax refund as the sole catalyst for business stability or growth, an MCA empowers you to seize control of your financial narrative.

It reflects a mindset that is agile, risk-aware, and unafraid to leverage available tools to sustain and propel your business forward. In essence, it's about embracing the wait for that refund as an opportunity to explore and understand the deeper financial fabric of your business, with the MCA standing ready to ensure that these insights are put into fruitful action.

Since 2005, Quikstone Capital Solutions has been a trusted advisor to thousands of merchants. Quikstone provides these merchants with easy, fast, and flexible working capital for all their business needs. If you need cash for your business, contact us today. We have only one goal: to help your business succeed.